Kazandıran Slot Oyunları: Hangi Saatlerde Oynamalıyız?

Kazand?ran Slot Oyunlar?: Hangi Saatlerde Oynamal?y?z?

Slot oyunları, casino dünyasının en popüler eğlencelerinden biridir. Hem eğlenceli hem de kazançlı olan bu oyunlar, oyuncuları büyük ödüllerle buluşturma potansiyeline sahiptir. Ancak, bazı saatlerin diğerlerinden daha şanslı olduğu düşünülmektedir. Bu yazımızda, Kazand?ran Slot Oyunlar?: Hangi Saatlerde Oynamal?y?z? konusunu inceleyeceğiz ve hangi slot oyunlarının kazandırma saatlerini keşfedeceğiz.

Slot Oyunlarında Kazanmanın Anahtarı

Slot oyunlarındaki kazanma şansınızı artırmak için bazı stratejiler ve zamanlamalar değerlendirilebilir. İşte dikkat edilmesi gereken önemli noktalar:

- Doğru Zaman Dilimi Seçimi: Bazı saatler, oyuncuların daha fazla kazanç elde etmelerine olanak tanıyabilir.

- Yüksek Ödeme Yapılan Oyunlar: Her slot oyununun kendine özgü ödeme oranları vardır. Bu oranları dikkate almak kritiktir.

- Bütçeyi Yönetmek: Oynamaya başlamadan önce bir bütçe belirlemek, kayıpları azaltmaya yardımcı olur.

Kazand?ran Slot Oyunları ve Saatleri

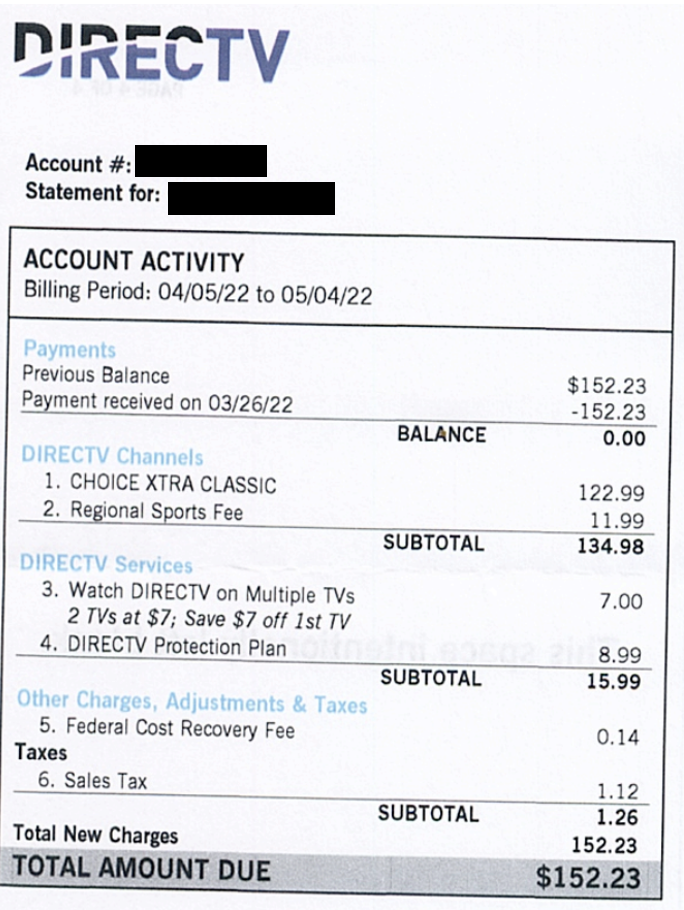

Farklı slot oyunları için oynama saatleri, oyuncunun kazanma şansını etkileyebilir. İşte bazı popüler slot oyunları ve onların kazandırma saatleri:

Oyun İsmi

Kazandırma Saatleri

| Sweet Bonanza |

17:00 – 19:00 |

| Gates of Olympus |

20:00 – 22:00 |

| big bass bonanza |

15:00 – 17:00 |

| Sugar Rush |

18:00 – 20:00 |

| The Dog House Megaways |

14:00 – 16:00 |

| Starlight Princess 1000 |

21:00 – 23:00 |

| Starburst |

16:00 – 18:00 |

| Buffalo King |

19:00 – 21:00 |

| Mustang Gold |

13:00 – 15:00 |

| Book of Dead |

22:00 – 00:00 |

| Zeus vs Hades: Gods of War |

20:00 – 21:30 |

Sonuç

Slot oyunları oynamak, hem keyifli bir deneyim hem de kazanç elde etme fırsatıdır. Ancak, doğru zamanlama ile bu deneyimi daha da kazançlı hale getirmek mümkündür. Yukarıda belirtilen oyunlar ve saatleri, kazanma şansınızı artırmak için dikkate almanız gereken önemli faktörlerdir. Unutmayın ki, her zaman eğlence öncelikli olmalıdır!

Sıkça Sorulan Sorular

Kazand?ran slot oyunlarını hangi saatlerde oynamalıyım?

Her oyunun kendine özgü kazandırma saatleri vardır. Örneğin, Sweet Bonanza 17:00 – 19:00 saatleri arasında daha fazla kazanç sağlayabilir.

Slot oyunlarının kazandırma oranları nedir?

her slot oyununun geri ödeme oranı (rtp) farklıdır. bu oranları göz önünde bulundurmak kazanç elde etme şansınızı artırabilir.

Slot oyunları ne kadar eğlencelidir?

Slot oyunları, sundukları eğlence ve heyecan ile oyuncular için vazgeçilmez bir deneyim sunmaktadır.

Umarız bu yazı, kazandıran slot oyunları ve hangi saatlerde oynanması gerektiği hakkında faydalı bilgiler sunmuştur. Şansınız bol olsun!

Kazandıran casino siteleri hakkında daha fazla bilgi için http://www.pbjcampaign.org/ adresine göz atın.