Peer-to-peer (P2P) lending stops using a classic financial otherwise borrowing relationship. Whenever you are searching for a loan, it is value evaluating P2P lenders because you comparison shop. P2P loan pricing should be the truth is lower, particularly when your credit score is good, in addition to application processes are much easier than what you’ll sense when borrowing from the bank off a classic financial. Even after less-than-primary borrowing, you could potentially possibly become approved for an easily affordable loan with these online loan providers.

What is actually P2P Borrowing?

P2P loans is actually funds that individuals and you will investors build-because the notable from fund you see out of your financial. People with offered currency bring so you’re able to provide it to prospects and you may businesses as a consequence of on line properties. An excellent P2P service (normally a site or mobile app) is a main opportunities coordinating loan providers and you will individuals, making the processes relatively simple and you can productive for all in it.

Great things about Borrowing That have P2P

Lower prices: You could usually acquire at the apparently low costs using P2P funds. Banking institutions and you may credit unions need to shelter over costs for department sites, other contours of company, and you can a giant employees. P2P borrowing is more sleek and generally speaking electronic-local, leveraging better the fresh technical. Thus, the purchase price build is much more optimized than simply regarding old-fashioned lenders. P2P borrowing from the bank is commonly a better deal than simply using a credit cards, but it is usually sensible examine rates. Since you get it done, pay attention to advertising prices, and view how fast possible pay off the debt.

Origination charge: You may have to pay a right up-top origination commission of just one% to eight% to pay for your loan with a P2P bank. You to definitely fees utilizes the amount you borrow, so good $step one,one hundred thousand financing you’ll happen good $fifty fee, to have examplepared into cost of a personal bank loan at a beneficial bank, such fees might be higher. Additionally, you’ll shell out an even bigger origination commission for one minute home loan, and also the personal bank loan processes may be simpler to navigate. Obviously, you’ll shell out additional charges getting points for example later payments.

Simple and fast: Searching for loans using antique avenues is actually a fuss, and you may once you pertain, you might have to endure a lengthy hold off when you look at the approval process. Taking out P2P loans can also be convenience the one to discomfort. The applying process is typically straightforward, and you will often find out seemingly rapidly regardless of if the loan is approved. Real funding might take approximately each week (due to the fact dealers choose whether or not to place money to your the loan). Choices is all the more quick, given that non-lender lenders on the web loans funds since the large traders.

Credit things, but blemishes is ok: Into the a scene where loan providers are unwilling to provide in order to some body with negative scratches to their credit score, P2P lenders are still an attractive choice. You will want decent borrowing locate acknowledged-a good FICO rating throughout the mid 600s or even more is the greatest-but P2P might give you alot more choices than are presently readily available in your area. As an instance, Upstart requires a minimum FICO otherwise Vantage rating regarding 620 so you can qualify for financing, even in the event somebody in place of tall credit history may also qualify. The even worse your own borrowing situation was, the greater these financing can cost you (in the form of higher rates of interest), but that’s the case with most lenders.

Sorts of Funds

P2P money started out since personal personal loans-you could obtain for your judge mission, therefore didn’t have in order to promise guarantee discover acknowledged for a loan.

Signature loans will always be widely known P2P funds, consequently they are plus the very flexible. (Explore our very own calculator lower than to determine what size mortgage helps make experience to you personally.) You are able to make use of the money to your debt consolidation, another type of automobile, renovations, or creating a corporate. If you want to use getting higher education, ensure in the event your own financial it permits borrowing from the bank regarding specific mission. Student loans was a much better selection for financial aid anyway.

Authoritative P2P lenders now render funds to have specific spends (such as for instance business fund or fertility procedures) including loans you could safer that have security.

Popular P2P Loan providers

The menu of P2P choice is consistently broadening. P2P fund became popular which have Excel and you will LendingClub, all of and therefore nevertheless render repaired-speed loan choices. If you’re going this new P2P financing route, it’s probably well worth getting a bid from of them a couple supply (including examining quotes of anyone else, if you need). Make sure to browse people lender on the radar, and read reviews of reputable offer before applying for a loan. To borrow, you need to render sensitive information like your Societal Security count, and you also should not give you to definitely information to an identity thief.

Several other an effective options are available. Specific may not be pure P2P lenders-these firms commonly individuals, nevertheless they are not antique financial lenders either. Several dealers fund these on the internet money, as well as the money can even come from banking companies (without any traditional lender-credit sense).

The way it operates

In order to borrow cash using a great P2P financing, see a loan provider and start the program techniques. Your generally have to promote factual statements about on your own, and the lender could possibly get ask for the plans for money. Extremely financing was unsecured loans, however lenders may render official packages in order to top serve you (like financing packages to installment loans, Nashville possess renovations or debt consolidating, eg). The lending company monitors your credit, and if you’re eligible for this service membership, investors normally funds the mortgage.

With a few P2P loan providers, you might have to hold off sometime to have financial support. The process takes several days or a couple weeks. In the event your loan try financed, you receive the money electronically and you will pay back the borrowed funds because of automatic lender drafts.

Your generally speaking pay-off more three to five years, but you can typically prepay without having any penalty, that helps it will save you money on notice.

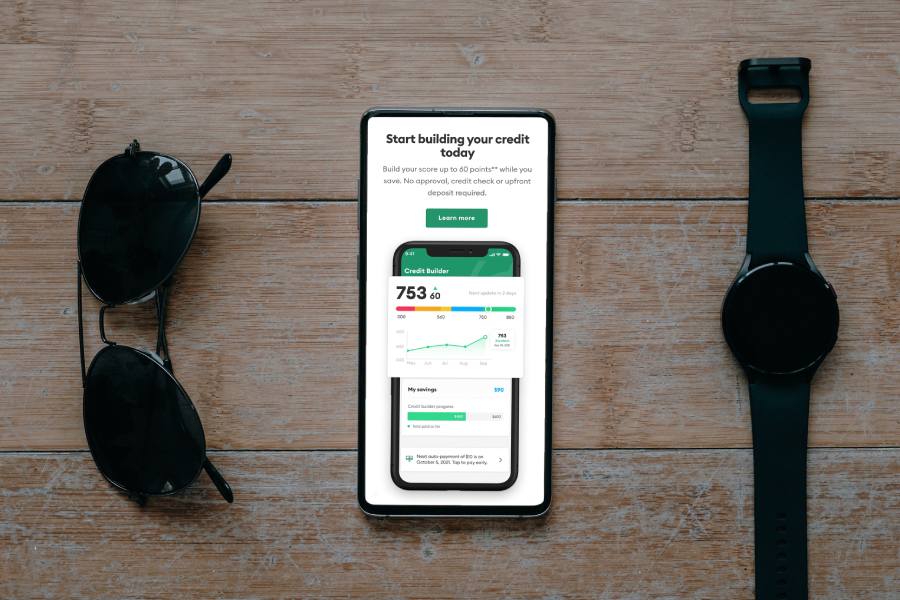

Credit rating: Punctual repayment on the mortgage generates your own credit. Very lenders report your passion so you’re able to credit agencies, that ought to help you borrow on most readily useful words subsequently. But not, when you are more likely to later money or standard into financing, their borrowing from the bank will suffer. It is crucial to generate repayments important in order to keep in touch with your own bank for people who slip towards the hard times.

Could it be Secure to Acquire Which have P2P?

Data: Established P2P loan providers will be guard your information as properly since the one almost every other lender carry out, and all communications is result due to an encrypted internet browser concept or application. Ergo, check out the data defense traditional when you see your P2P financial.

Privacy: Your own name are remaining invisible off private loan providers, but comment privacy procedures very carefully to understand what suggestions buyers often located.

Rates: Interest rates are typically just like the individuals discover elsewhere. You can almost certainly shell out less having P2P lending than just might having an instant payday loan.

Should you get that loan with a varying price, be aware that rates of interest can also be increase. Whenever they would, your own payment increases.