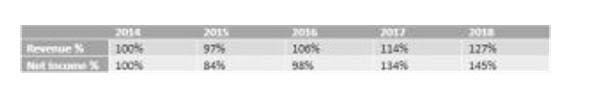

The market value is the value of a company according to the financial markets. The market value of a company is calculated by multiplying the current stock price by the number of outstanding shares that are trading in the market. When it comes to assessing a company’s financial health, one metric that often comes into focus is book value. This concept is integral to understanding the intrinsic worth of a company, providing insight into its financial stability and value as reflected in its accounting records.

Book Value vs. Market Value: An Overview

- When stock trading prices for a company fall at or below BV (a price-to-book ratio below 1.0), the company is undervalued and shares are trading at prices lower than what they are actually worth.

- In this case, that total of $24.1 billion would be the book value of Coca-Cola.

- The term book value is derived from the accounting practice of recording an asset’s value based upon the original historical cost in the books minus depreciation.

- Fair value is a reasonable and unbiased estimate of the intrinsic value of an asset.

- There is a difference between outstanding and issued shares, but some companies might refer to outstanding common shares as issued shares in their reports.

- There are a few key reasons why the market value may be different from the book value.

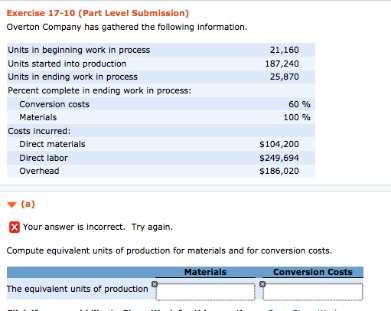

It is necessary to compare various ratios and factors to properly anyalse a company’s value. To get BVPS, you divide the figure for total common shareholders’ equity by the total number of outstanding common shares. To obtain the figure for total common shareholders’ equity, take the figure for total shareholders’ equity and subtract any preferred stock value. If there is no preferred stock, then simply use the figure for total shareholder equity. Book value is the accounting value of a company’s assets minus its liabilities.

Step 1: Identify Total Assets

There are a variety of ways to value an asset and record it, but the most common is taking the purchase price of the asset and subtracting its depreciation cost. Liabilities include both current liabilities (e.g., accounts payable, short-term debt) and long-term liabilities (e.g., bonds payable, long-term loans). At its core, book value represents the amount shareholders would theoretically receive if the company were liquidated and all its assets sold off at their accounting value. It provides a baseline measure of value, especially for companies with significant tangible assets such as real estate, machinery, or inventory. Note that in accounting, the concept of fair value is not applied to all assets.

It approximates the total value shareholders would receive if the company were liquidated. In accounting and finance, it is important to understand the differences between book value vs fair value. Both concepts are used in the valuation of an asset, but they refer to different aspects of an asset’s value. In this article, we will discuss book value vs fair value in detail and indicate their key distinctions. The book value of a company will change over time as the assets and liabilities of the company change.

For example, if a company chooses to use the straight-line method of depreciation, its book value will decrease more slowly than if it had chosen the accelerated method. This is because the straight-line method spreads the cost of an asset over a longer period of time, resulting in a lower book value. Inflation can also have an impact on book value, as it can reduce the purchasing power of assets. This means that, in order to maintain the same level of book value, a company would need to increase its assets. While book value can be a helpful metric, it is important to remember that it is an accounting value rather than a market value.

The book value of a company is its total assets minus its total liabilities. When stock trading prices for a company fall at or below BV (a price-to-book ratio below 1.0), the company is undervalued and shares are trading at prices lower than what they are actually worth. Face value is the nominal value of a security, such as a bond, as determined by the issuer. For a bond, it represents the amount to be paid to the investor at maturity. Book value is the net value of a company, calculated as total assets minus total liabilities. Face value is generally always a fixed number while book value changes as the company’s performance changes.

Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. The book value is also sometimes referred to as the « net asset value » or the « carrying value » of the company. If it is a physical asset, then depreciation is used against the asset’s original cost. If the asset is an intangible asset, such as a patent, then amortization is used against the asset’s original cost.

When an asset is initially acquired, its carrying value is the original cost of its purchase. The carrying value of an asset is based on the figures from a company’s balance sheet. Both depreciation and amortization expenses can help recognize the decline in the value of an asset as the item is used over time. The term book value is derived from the accounting practice of recording an asset’s value based upon the original historical cost in the books minus depreciation. Carrying value looks at the value of an asset over its useful life; a calculation that involves depreciation.

What Does a Price-to-Book (P/B) Ratio of 1.0 Mean?

As with all financial metrics, its usefulness depends on how it is used. Book value is a fundamental financial metric that provides insights into a company’s net worth based on its accounting records. It is calculated by subtracting total liabilities from total assets and offers a baseline measure of a company’s valuation. While it has its limitations, book value remains a valuable tool for investors and analysts, especially when used in conjunction with other financial metrics.

Book Value per Share

Book Value per Share (BVPS)Book value per share (BVPS) calculates the book value of a company’s equity held by common shareholders on a book value is also referred to as per-share basis. A company’s stock may be cheaper if its book value per share (BVPS) exceeds its market value. This indicates that the current stock price doesn’t accurately represent the worth of the company’s assets.

What are some alternative measures of a company’s worth

In order to help you advance your career, CFI has compiled many resources to assist you along the path. Essentially, the estimation of an asset’s fair value is a generally complicated process. Determining the asset’s fair value is generally guided by the accounting standards. IFRS and US GAAP provide guidance on how to measure the fair value of an asset.

A company’s book value is determined by the difference between total assets and the sum of liabilities and intangible assets, such as patents. Book value in this definition is determined as the net asset value of a company calculated as total assets minus intangible assets and liabilities. The book value of a stock is theoretically the amount of money that would be paid to shareholders if the company was liquidated and paid off all of its liabilities. As a result, the book value equals the difference between a company’s total assets and total liabilities. Although investors have many metrics for determining the valuation of a company’s stock, two of the most commonly used are book value and market value. Both valuations can be helpful in calculating whether a stock is fairly valued, overvalued, or undervalued.

Book value is the net value of a company after deducting the total liabilities. It is found by subtracting the debt from the value of all its assets. It is the value of the asset after deducting its accumulated depreciation from the original cost. Book value and market value are just two metrics to evaluate a company. Others include the debt-to-equity (D/E) ratio, earnings per share (EPS), price-to-earnings (P/E) ratio, and the working capital ratio. Companies own many assets and the value of these assets are derived through a company’s balance sheet.

In other words, the market may not believe the company is worth the value on its books or that there are enough future earnings. In theory, if Bank of America liquidated all of its assets and paid down its liabilities, the bank would have roughly $290 billion left over to pay shareholders. The need for book value also arises when it comes to generally accepted accounting principles (GAAP). According to these rules, hard assets (like buildings and equipment) listed on a company’s balance sheet can only be stated according to book value.