- Released members of brand new Chose Set aside have to fill in a copy regarding its annual Old-age Things Report as well as proof respectable service and you will discharge.

- Surviving partners that don’t located dependence pros need fill in their spouses DD Means 214, the matrimony licenses, as well as their partners death qualification, together with a copy off Virtual assistant Away from 21P-534-Is.

- Surviving spouses which located dependence positives have to print and completed Virtual assistant Setting twenty-six-1817.

You can buy their COE from the eBenefits webpages or post your posts and you can a completed Va Form twenty six-1880 on Department regarding Pros Points.

Va Mortgage Constraints

There are no certain Virtual assistant loan limits, however it is doing your financial exactly how much you might obtain. Of several lenders require you to follow the compliant loan limitations . This means, in the 2022, predicated on such limitations, you might not acquire over $647,2 hundred, however, you to definitely matter tends to be large if you’re in an excellent high-pricing urban area.

Entitlement pros could work to your benefit. Entitlement ‘s the number you’ve got designed for a guaranty toward that loan. Those with complete entitlement never has limitations more than lenders out of $144,000. For many who default to the financing more $144,100000, this new Virtual assistant will pay your financial around twenty-five% of the amount borrowed.

- You have never made use of your house financing work with otherwise

- You have paid off an earlier Virtual assistant mortgage completely and offered this new assets or

- You have made use of your house mortgage work for however, paid the money into the full once you undergone an initial business otherwise foreclosure.

Given that there is reviewed the response to « How does an excellent Va loan works? » let’s discuss the real steps on how best to get an excellent Va mortgage.

1. Score A certificate From Eligibility

It is essential to get an excellent COE basic for the reason that it assures your own capacity to get a good Va loan and will be offering proof your own armed forces service. If you don’t meet up with the qualifying conditions, you are able to talk to your lender about other available choices, including the possible opportunity to sign up for a conventional loan.

2. Sign up for Preapproval

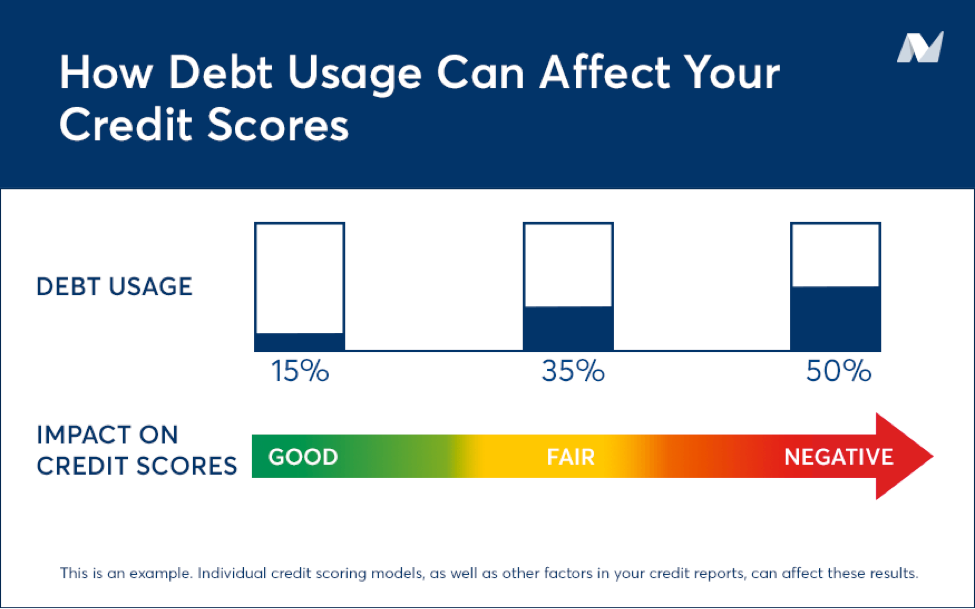

Home financing preapproval ‘s the first step along the way. A loan provider takes a glance at your finances and you can does a great softer credit score assessment so you can determine how much household your are able to afford. It offers best of your sorts of homes you can look getting on your spending budget as well as have can make you alot more persuading regarding the sight out-of a seller. Manufacturers need now offers out-of potential home buyers having preapprovals at hand far more positively than those who do n’t have a great preapproval to own a lender.

3. Create A deal

2nd comes and then make a deal into property that meets Virtual assistant guidelines. Va services should have minimum assets requirements (MPRs) to ensure the house you want to invest in is secure and you will structurally voice and get fit squarely into local requirements. Belongings which do not satisfy these guidelines are going to be remodeled to meet with the appropriate requirements.

A good Va house appraisal means you aren’t expenses too-much getting a home, and your lender need to be aware that guidance!

An appraisal takes a go through the basic construction of your domestic and you will comparable functions to evaluate this new fair market price out-of your property. The latest Va domestic appraisal means that the fresh MPRs that people mentioned during the last step are found.

5. Romantic To your Family

Ultimately, you’ll make a purchase render to buy property and discuss to the supplier to address people counteroffers, come up with a sales deal by using a genuine estate agent or lawyer and you will intimate on the household. You can easily indication the loan files in the closure along with your financial will explain the www.cashadvancecompass.com/installment-loans-oh/fresno/ terms and needs of one’s financing, including making repayments on lender per month.