Mortgage certification is pretty upfront getting a fundamental W-2 employee, exactly what happens when you are your own employer? Even though the process looks sometime other to possess self-employed individuals, you certainly do not need to be concerned. All of us have of info that you’re going to have to make your app techniques seamless.

What do We Pick?

Once you begin the loan app procedure since a self-functioning debtor, the loan manager will for the following to prove one to you are a strong candidate for a mortgage:

- Income balances of your own debtor

- The new financial fuel of the business

- Demand for the merchandise or solution offered by this new borrower’s providers

- The right that the debtor will maintain a steady flow out of income throughout the years

Documents Needed for Earnings Confirmation

For people who prepare the mandatory papers mentioned lower than, their financial can get all the devices they must improve the cash verification procedure:

- The past a couple of years out-of tax statements for you along with your team, in addition to every dates and you will support worksheets

- Per year-to-big date profit and loss (P and L) declaration that will tend to be a routine C otherwise Setting 1120S

- Latest balance sheet

- Page from your own accountant noting your nonetheless in operation

- Duplicate of the newest organization license or business filings

If you have been notice-useful less than 2 years, Federal national mortgage association recommendations enables qualification of at least twelve weeks off thinking-a job record. Qualifications because of it exclusion is enabled if debtor has proof of creating an elevated or equivalent quantity of income inside an effective equivalent profession prior to they truly became mind-employed.

A means to Help Improve your Software

In addition to providing the called for documentation, there are several ways in which you might prepare to evolve brand new energy of your own application.

Eradicate Income tax Write-offs

Self-employed individuals have a tendency to just be sure to disregard as many business expenditures as you are able to to get a bigger reimburse whenever tax time appear as much as. not, lenders consider your earnings once taxation establish-offs. Ergo, your stated earnings seems lower than it is whenever a good lot of expenditures try subtracted. Consider composing away from less expenses two years in advance of your financial travels to support qualification.

Lead Which have An effective Credit history

Good credit rating will make an excellent borrower’s document much more attractive to an enthusiastic underwriter. Bust your tail to switch your credit rating before starting your own home financing excursion.

Reduce your Personal debt-To-Earnings Proportion

Debt-to-earnings ratio (DTI) performs an important character in financial degree for everyone potential customers. In case your DTI are reasonable, there clearly was reduced chance that you won’t pay off your loan.

personal loan with no acusition fee

When you yourself have a financial obligation-to-earnings proportion off 50% otherwise over, you will need to lower your expenses before you apply to suit your home loan.

We are going to use the income that you report on the taxation so you’re able to calculate the DTI. For this reason, for people who write off a great deal of team costs to reduce your nonexempt income, but i have loads of credit card debt, your own DTI might be high.

Keep Business and private Costs Independent

As soon as we view the debt, we’re deciding on your own personal personal debt. For individuals who maintain your business costs independent out of your personal, brand new revealing processes try simplified.

Maintain Expert Info

Before you could meet with your financial, work tirelessly to keep meticulous records of cash and you can expenses. Collect most of the necessary documentation in the above list and continue maintaining it planned and you will stored in a rut.

Generate A bigger Advance payment

Big down-payment financing means there was less money needed seriously to acquire initial, that may reduce steadily the opportunity your debtor will default into the financing. Thought saving even more for the down payment to strengthen the file, and replace your likelihood of qualification.

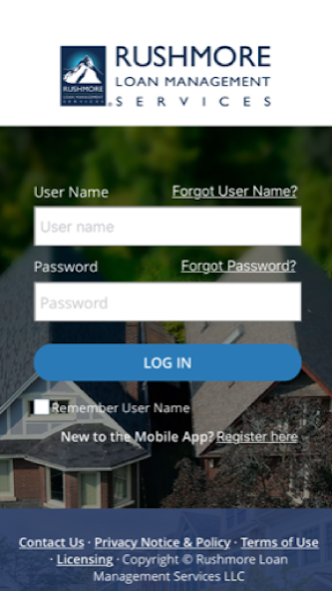

Initiate your mortage application otherwise correspond with an authorized Home mortgage Manager to review and therefore loan is best option for your.